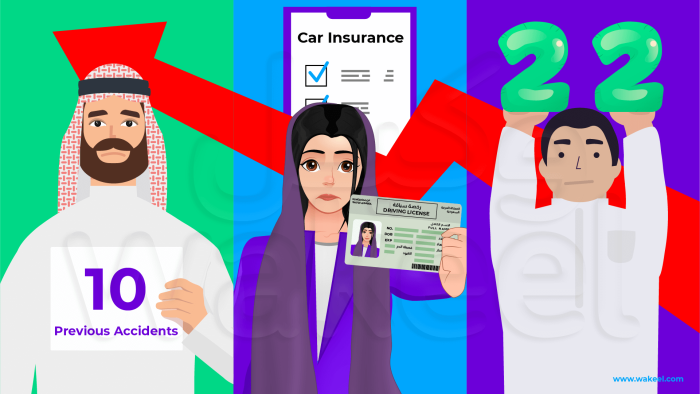

3 drivers who pay the MOST for their car insurance in Saudi

Ever tried to compare car insurance online only to find out that you’ll be paying a lot more this year than what you were paying last year? If so, you are not alone—Car insurance in Saudi Arabia can be expensive, but some drivers have it worse than others!

👇 Let’s find out which drivers are paying the highest car insurance prices & what you can do if you’re one of them.

#1. Young drivers under the age of 25

One group that undoubtedly pay the highest price for car insurance in Saudi is young drivers (aged 17 to 25.) A big reason for this is statistics!

Statistically, drivers under the age of 25 are more likely to make mistakes, break traffic rules, get into accidents, and cost the insurance company a LOT! So, to protect themselves, car insurance companies charge young drivers a bit more to cover the risks.

🗝️

If you’re looking for cheap car insurance as a young driver, consider using Tawuniya Drive.

What’s Tawuniya Drive?

Tawuniya Drive is an app on your phone that will monitor your speed and driving style and send the data to Tawuniya. If you can show that you’re a responsible driver, you’ll be able to get cheaper car insurance prices from Tawuniya. Plus, you’ll earn different rewards every week!

👉 Find out how Tawuniya Drive app can turn safe driving into Rewards.

#2. New, inexperienced drivers

It’s not just young drivers who pay more—new drivers, regardless of age, will also find car insurance to be expensive. What makes car insurance more expensive for new drivers is the lack of experience.

In Saudi Arabia, you’re considered a newbie for the first two years after getting your driving license. Once you’ve been driving for over two years and you’ve started building a no-claims discount, you should start to see your car insurance get cheaper.

🗝️

If you’re looking for cheap car insurance as a new driver, think about sharing a car with an experienced family member – a sibling, parent, or spouse who’ve been driving for years – until you gain the experience and improve your driving skills.

🚨 Here’s something important

Unless you want to be responsible for paying for repairs or medical bills if you cause an accident, make sure the car owner adds your name to their comprehensive insurance policy as an additional driver. This way, you’ll be covered to drive their car, with the same protection they have.

#3. Drivers with previous accidents

Last but not least, car insurance is more expensive for drivers with a bad driving history than anyone with a clean record. For car insurance companies, someone with multiple at-fault accidents or serious traffic violations (like wrong-way driving) is a “high-risk” driver.

And when you’re a high-risk driver, the insurance company charges you more for your car insurance because they think you’re more likely to cost them money.

How long do accidents stay on my record?

When you get a quote, you’ll notice that most car insurance companies in Saudi will ask about the number of accidents you had in the last 3-5 years — Typically, that’s how long previous accidents/ claims stay on your record.

🗝️

If you’re looking for cheap car insurance as a driver with a history of accidents, you’ll simply need to be more careful on the road!

The longer you go without being in a car accident or making a claim, the higher the discount percentage you’ll get from Najm.

What else can you do to make your car insurance cheaper?

Things like what car you drive, which car insurance do you need, and which company are you buying from all determine how expensive your insurance will be. So, the best way to make sure you’re paying as little as possible is to use a comparison website to compare car insurance quotes every year!

When you use wakeel, we’ll show you quotes from some of Saudi’s best car insurance companies. You can compare the policies based on price, cover level, and add-ons!

Another thing you can do to keep your car insurance low is make sure to renew on time. Having a gap between your previous insurance expiry date and your new insurance start date will make you lose your NCD eligibility, and this will also raise car insurance rates in response — so make sure to renew on time.