Car Insurance Rules & Rights for Every Driver in Saudi

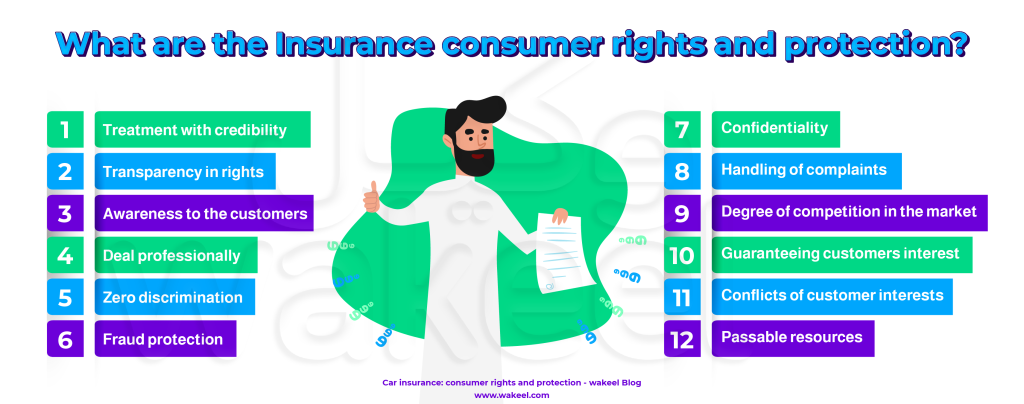

Car insurance is a two-way contract. As a consumer, you have specific rights and rules to follow. And so do car insurance companies in Saudi! Here’s what you need to know to stay on the safe side when dealing with car insurance companies in Saudi Arabia 👇

When you know better, you do better

Knowing your rights and responsibilities is the only way to tell if your insurance company is falling short, or if they’re actually right to take legal action.

As a policyholder, it is your responsibility to

- Tell the truth, always. When you’re getting a car insurance quote or filing a claim, be honest with the car insurance company.

- Update your info when it changes.

- Read your documents carefully.

- Ask questions if you’re confused.

- Follow the complaint process.

you also have the right to

- Receive fair treatment and great service.

- Choose the coverage that fits you: Comprehensive or third-party car insurance

- Get all the details on your car insurance quote to compare prices and coverage easily.

- Get you car insurance claim settled within 15 days.

- Know exactly the reason why a claim was denied

- Choose how you’re compensated: cash settlement vs car repairs.

- Receive fair compensation when insurance declares your car is a total loss.

- Disagree if you think the compensation amount isn’t right.

- Ask insurance company to cover an accident with an expired license (as long as you renew it within 50 days of the accident).

- Cancel your car insurance policy, or switch companies anytime

- File a complaint against an insurance company.

When an insurance company isn’t treating you right

You can file a complaint against your car insurance company in Saudi Arabia if they don’t follow the rules of Compulsory Motor Insurance Policy or Comprehensive Motor Insurance Rules.

Here’s where you can complain about insurance company in Saudi.

1️⃣ Start with the insurance company itself – Try to resolve the issue directly.

2️⃣ Escalate to the Insurance Authority – If the company doesn’t respond, escalate the complaint to the Insurance Authority Customer Protection Unit.

3️⃣ Go to IDC aka Insurance Dispute Center – As a last resort, you can take an insurance company to court in Saudi.

Buy insurance you can trust

At the end of the day, your car insurance should work for you — not the other way around! If you feel like you’re not getting the service you deserve, remember that you always have options. Don’t settle for less! Take the time to compare insurance companies in Saudi, weigh your choices, and pick a car insurance that you can trust.

After all, the best way to protect yourself on the road is to start with the right insurance.