Car Insurance Fraud in Saudi

Fraud runs rampant in business, especially within the insurance industry. It’s defined as any deceitful act aimed at getting a financial gain, directly or indirectly, causing a loss to the deceived party. In most cases, car insurance fraud occurs when someone tries to abuse their comprehensive insurance to collect payouts.

Insurance fraud isn’t a victimless crime; it hits insurance companies, individuals, and society’s finances. Dr. Mohammad Alsuliman, CEO of Najm for Insurance, estimated car insurance fraud cost around SR 250 billion in 2019. As fraud cases climb, everyone in Saudi could see their insurance rates rise. That’s why understanding fraud prevention matters for everyone.

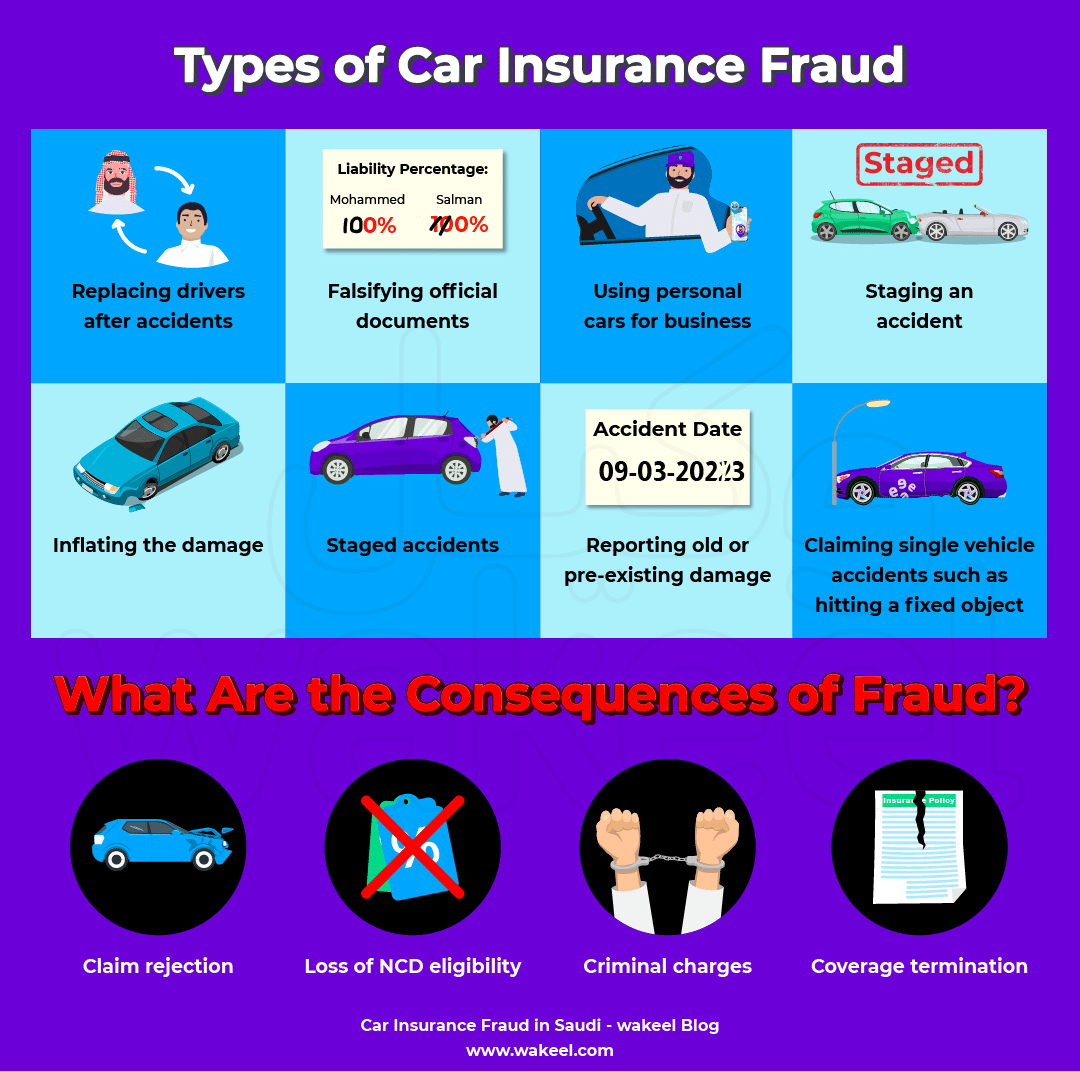

Types of Car Insurance Fraud

There’s a range of car insurance fraud, from lying on a claim to staging accidents. And as a response, dashcams are gaining popularity in Saudi. Here are some examples of what constitutes fraud when filing a car insurance claim:

- Replacing drivers involved in accidents with someone who’s insured or older – Beware! you could face legal charges and a fine of 10,000 SR.

- Providing false information about the accident or falsifying official documents.

- Exaggerating and inflating the damage or injuries sustained.

- Using personal cars for business, learn about car insurance exclusions.

- Staging an accident to cause damage or destruction to the insured car intentionally – this also includes theft and arson.

- Reporting old or pre-existing damage.

How Najm Detects Fraud

In 2019, Najm formed a partnership with SAS to detect insurance fraud. Utilizing Artificial Intelligence and Machine-Learning technologies, Najm aims to improve investigations efficiency and develop better quality alerts for its investigators. Ai can aid Najm investigators in two ways:

- Ai is used to continuously monitor behavior to look for patterns indicating large-scale fraud. A person making multiple claims, or has a history of suspicious claims – is a potential red flag that Ai can highlight for further investigation.

- Also, Ai can assess the accident, classify car damage, and estimate costs/

As a consumer, you too can help prevent fraud and protect yourself:

- Inform Najm’s investigator of any discrepancies in the description of the accident.

- Avoid conspiring with other drivers who offer to transfer the responsibility to another person, or ask you to be liable for the damage.

What Are the Consequences of Fraud?

- Facing criminal charges

- Cancellation of insurance policy

- Not receiving compensation for a fraudulent claim

- Losing your No Claims Discount (NCD)

- Canceling your car insurance policy and losing coverage.

Worst of all is being a victim of insurance fraud. Often, “ghost brokers” offer attractive car insurance claiming they can get you cheap car insurance. However, these dishonest agents might use false information or alter your car insurance policy. In other cases, ghost brokers will provide a legitimate policy, but will be quick to cancel the policy and pocket the refund for themselves. Only when an accident occurs, you find that you have no insurance to pay your claim and must cover the loss on your own.

To protect yourself, get your car insurance from a licensed company in Saudi.

Don’t become a victim of car insurance fraud, DIY!

To protect yourself from falling victim to these scams, it is highly recommended to use licensed price comparison websites. These platforms provide a reliable and secure way to compare car insurance offers from reputable companies, ensuring that you receive the best coverage at a fair price. Use a licensed price comparison website to avoid the schemes of ghost brokers and make informed decisions when it comes to your car insurance needs. Stay vigilant, stay informed, and stay protected!