Car Make and Model: How it Matters for Insurance

Although most people are well aware of how their driving record affects their insurance rates, many don’t realize that the car’s type dictates how much (or little) they’ll pay for car insurance. Often, insurers charge higher rates for certain types of cars (i.e., cars make and model) due to their high rates of accidents, theft, and insurance claims. So, the best way to find out how much a car might cost to insure is to request quotes from multiple insurance companies— and compare car insurance prices online!

First of all, what is a car’s make and model?

Car “make” and “model” are both used to identify and describe cars. While the two words might sound synonymous, it’s important to understand the difference when you’re buying a car or buying car insurance.

Essentially, car make is short for “automaker” which means the manufacturing company or the brand that makes the car. Whereas, the model refers to a specific type of vehicle produced by the brand. Usually, the car’s manufacturer makes several body style options for their models like sedans, hatchbacks, SUVs, and more. Also, the model year of a car makes a huge difference since the cost of car insurance changes with the age of a car.

Then, the next question is

Now, how can I identify my car’s make and model?

If you aren’t sure what your vehicle’s exact make and model are, there are 3 ways to find out.

- Check the owner’s manual: If you bought a brand-new car and you can’t determine its make or model yet, then your answers can be found on the cover of the car owner’s manual.

- Check the car’s documents: If you bought a used car or have had the car for some time now. You can find vehicle’s make displayed on both vehicle registration and MVPI inspection report. You can also find the car make and model by the registration number, through Absher traffic services .

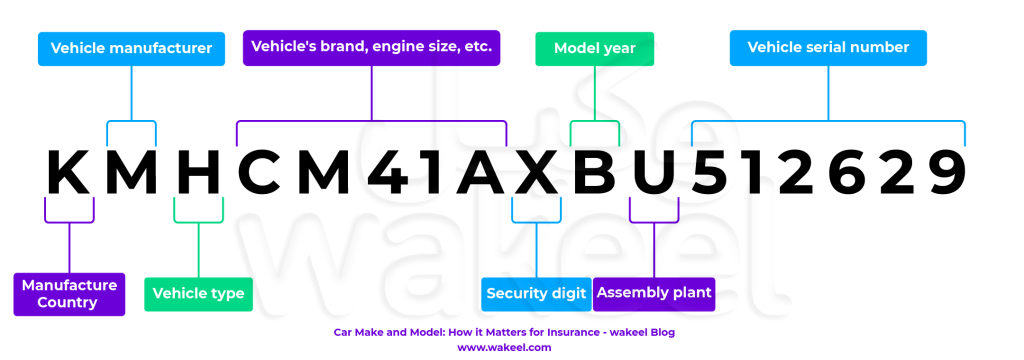

- Use the vehicle’s VIN: VIN, short for a vehicle identification number, is a unique code for each car. The 17-character VIN identifies a lot about your car, including the model year. Here’s what each character (a number or letter) represents:

- 1st character: which country manufactured the vehicle.

- 2nd character: The manufacturer

- 3rd character: The vehicle type

- 4th–8th characters: Brand, body style, model, and series

- 9th character: Security check number

- 10th character: Model year of the vehicle

- 11th character: Indicates which plant assembled the vehicle.

- 12th–17th characters: Vehicle’s serial number

So, how does the car make & model impact insurance rates?

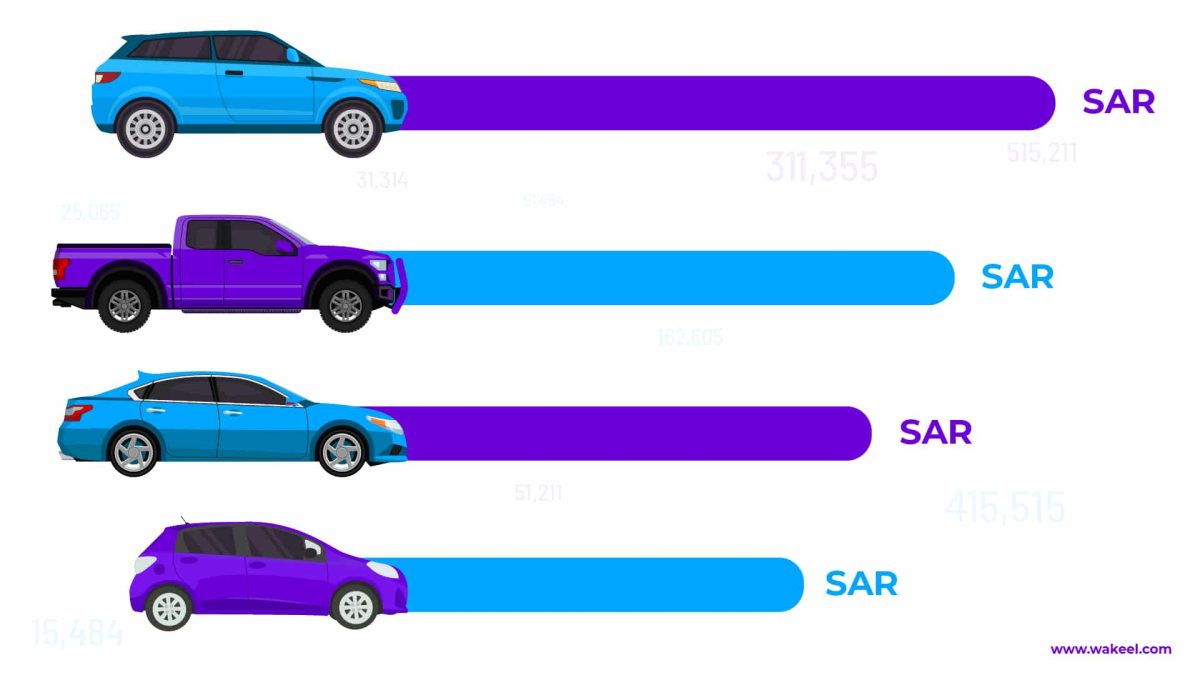

- Engine size: The larger an engine your car has, the higher the cost of your insurance will be. For example, insurance companies consider sports cars drivers more prone to accidents because such cars are driven at higher speeds.

- Trim Size: Typically, a high-end car will cost more to insure than a standard sedan. This is because luxury cars tend to have more high-tech features and accessories. So, any accident is going to be an expensive one.

- Model Year: Naturally, car value decreases over time due to depreciation. The older the car, the cheaper it costs. Therefore, the cheaper it is to insure. Older cars’ costs are cheap and therefore cheaper to insure.

- Car Safety: Safety features, especially if they’re backed up by studies, can lower car insurance prices. Then as well, any modification that raises safety concerns will almost certainly affect your insurance. So, here are a few things to remember when modifying your car.

In a nutshell, car’s make and model are important for both drivers and insurers in Saudi. Therefore, before buying a new set of wheels, you’ll have to do your research about the factors that affect the price of car insurance in Saudi. So, perhaps it’s wise now to start comparing online car insurance in Saudi – to avoid any surprises later.

Are you covered?

A proper insurance policy will work as a safety net for you and your car against misfortune. Saudi price comparison websites offer you a safe and efficient way of buying the right insurance policy for your car. Get detailed quotes, and compare car insurance prices online from multiple insurance providers in Saudi. Compare your options independently, easily, and effortlessly!