Updated:

August 28, 2025

August 28, 2025

Post date

3 minutes read

3 minutes read

Buying car insurance in Saudi isn’t just about finding the cheapest price online. Sure, it feels good to save your money. But the most important thing to check is when you buy comprehensive car insurance the deductible (that’s the amount you pay if you cause an accident).

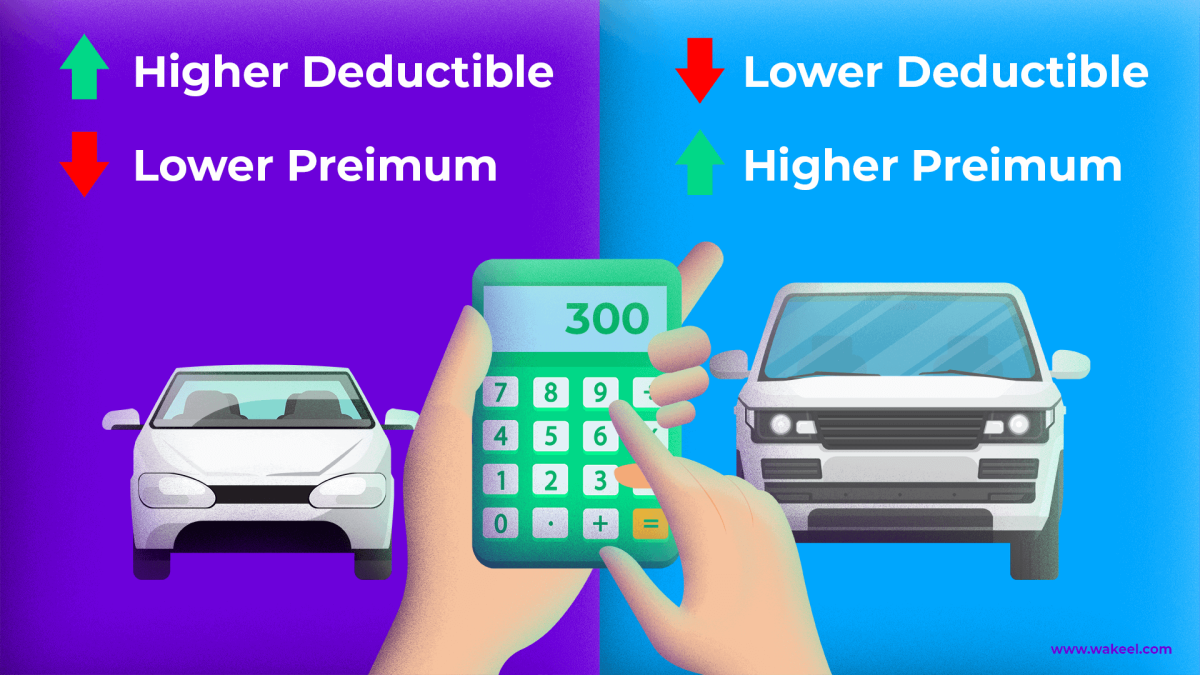

Yes, the higher the deductible, the lower your car insurance price will be. But remember: if something happens, you’re the one who has to pay that deductible—even if the car is a total loss!

Compare Car insurance quotes

Get A QuoteWhat’s a deductible, exactly?

In Saudi Arabia, the deductible is the part you pay only when the accident is your fault, or when there’s no other party.

When you compare comprehensive insurance prices in Saudi, you’ll see different deductible options—500 SAR, 1000 SAR, or 7000 SAR. The option you choose will change the price of your insurance:

- High deductible → cheaper car insurance price

- Low deductible → more expensive car insurance

Choosing a higher deductible to lower your car insurance can be a smart move, but it’s not the right choice for everyone!

When is it okay to buy cheap car insurance with high deductible? ✅

The smart way is to look at both the price AND the deductible when you compare car insurance online. A cheap price might make you pay a painful amount after getting into an accident. A slightly more expensive insurance offer could save you from paying anything at all after an accident.

Before you raise your deductible, consider these 3 points:

1. do you have a clean driving record?

- If you trust your driving skills and have a clean record, chances are you won’t need to file many claims.

- In this case, choosing a higher deductible makes sense because you’re less likely to ever pay it, and your Najm NCD will help you save more!

But if you had a few accidents, or your car often gets bumped while parked, a lower deductible will save you stress because you’ll need to pay it every time you file a claim.

2. is it higher than the average cost of a repair?

For example, if you choose a 7000 SAR deductible for a 70000 SAR car — you might be paying for insurance you can’t use! Your insurance will only help you in serious accident or if the car is totaled. If a repair costs 5000 SAR, you will not get any help from your insurance because the cost is less than your 7000 SAR deductible.

3. Can you really afford it?

Most importantly, only go If you can easily pay the deductible anytime without throwing off your whole budget, then there’s no risk in getting cheap car insurance with a higher deductible.

Final word: Balance is everything

Choosing the right deductible when buying comprehensive car insurance is all about balance:

- What you pay now (insurance price)

- Versus what you might pay later (the deductible)

If you only focus on finding the cheapest car insurance in Saudi, you could end up paying much more when it matters most. Think about your budget, how likely you’re going to be invovled in an accident, and your car’s value.

👉 Before you hit “buy,” take a few extra minutes to compare both price and deductible. That’s how you find insurance that works for you, not against you.