6 Factors that increase your car insurance in Saudi

You may have noticed that your car insurance policy costs much more than it did last year! So, what made your car insurance rates go up? Or, maybe, you noticed that one of your family members or friends got a cheaper car insurance policy price than you did? Well, comprehensive car insurance rates aren’t the same for everyone and there are good reasons for that. In fact, there are different standards that car insurance companies use to determine your insurance policy rates. Some of these factors can make your car insurance price shoot up. Consequently, wakeel has broken down the leading factors that increase your car insurance rate and the different ways to ensure getting the best car insurance prices in Saudi Arabia.

The most significant factors in Saudi Arabia in determining a car insurance policy rate

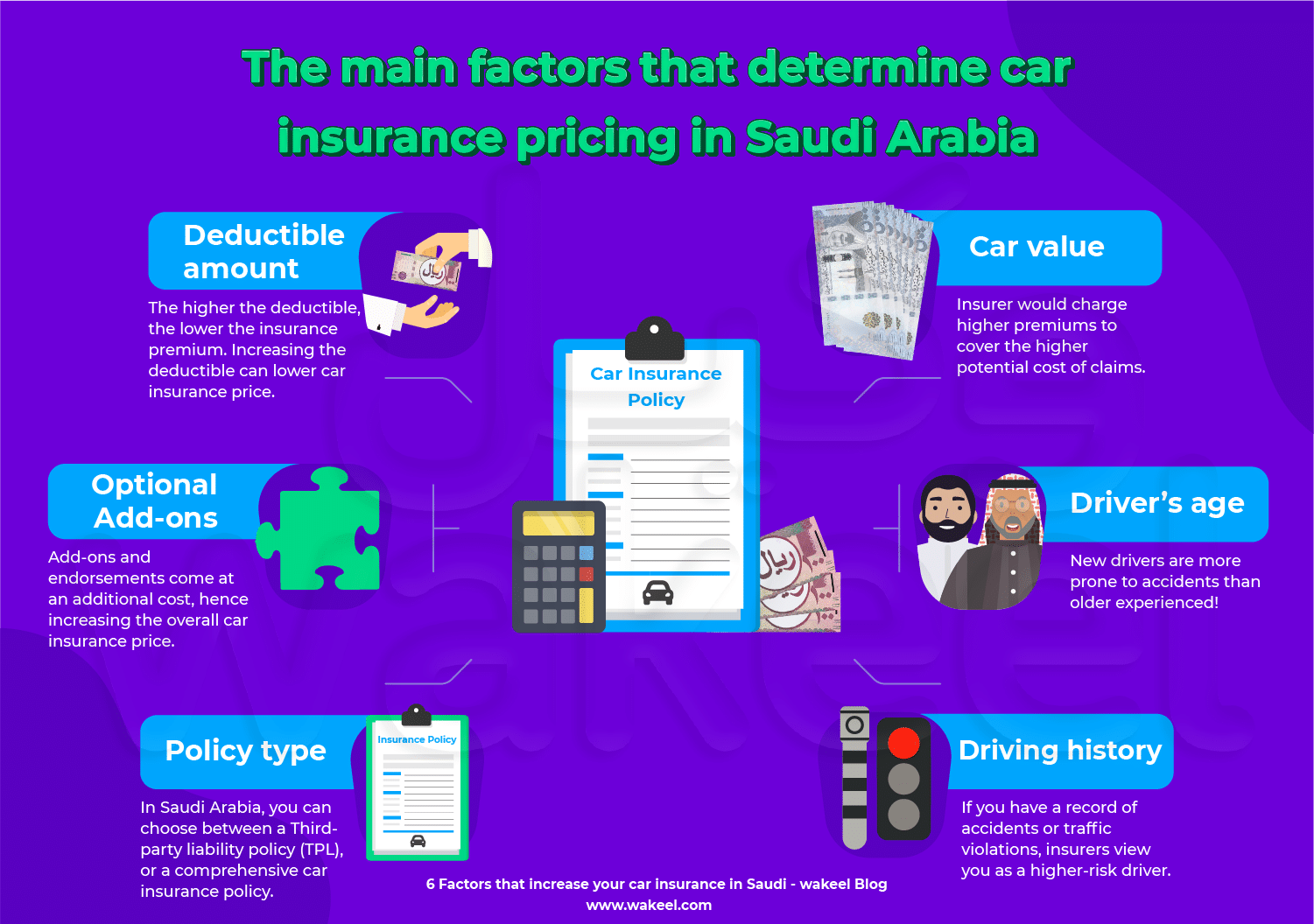

First of all, let’s discuss the criteria insurance companies in Saudi use:

Some factors are related to your

- Car value: There is a relationship between the value of your car & insurance claims for car repairs caused by traffic accidents… A luxurious car or sports car costs more, spare parts cost more than a regular motor. That’s why a premium car insurance policy costs a lot more.

- Driver’s age: Most of the time, new drivers are more prone to accidents than older experienced Saudi insurance companies charge more to young drivers with additional coverage on their policy. Find out about 6 costly car insurance mistakes to avoid!

- Traffic Record: When you apply to purchase a new insurance policy. The company will assess your traffic record and evaluate your driving on Saudi roads. You can count this as a motive to clear your history record and earn a no-claim discount.

Other factors are related to your coverage

- Deductible amount: It’s the amount you chose to pay as ‘the policyholder’ to cover damages resulting from an accident, while the insurance company covers the rest. The higher the deductible amount you choose to pay, the lower the insurance policy rate you get.

- Optional Add-ons: Saudi insurance companies, provide their customers with additional add-on services like extending geographical coverage, towing services, hire cars, and other options that you can add up to the price of your insurance policy.

- Policy type: In Saudi Arabia, you can choose between a Third-party liability policy (TPL), or a comprehensive car insurance policy. Each policy provides you with financial/medical coverage which can increase your insurance car policy rates.

Tips on how to get a reasonable policy rate next time you insure your car:

- Choose your insurance price wisely: When choosing your insurance policies, pick a policy that provides you with the best financial coverage regarding your car value at the best price.

- Choosing Add-ons: As significant as they are, you should pick them wisely and carefully. Add-ons are one of the main reasons for the increase in car insurance prices. Thus, only buy add-ons that fit your needs.

- Determine an appropriate rate for your deductible: If your car’s spare parts are affordable. Then take a lower \deductible rate and, that will help in decreasing your car insurance policy rate.

- Agency repairing: It is better to repair your car in a qualified workshop, rather than the agency if your car is older.

Quote & Save Online

In the end, it is highly recommended to visit an online comparison website to compare and buy car insurance policies online to get the best option. Saudi price comparison websites offer you a safe and efficient way of buying the right insurance policy for your car. Get detailed quotes, and compare car insurance prices online from multiple insurance providers in Saudi. Compare your options independently, easily, and effortlessly!