How Traffic Violations Affect Insurance

There are many things that you should experience at least once in your life, but we can be sure that no one wants to receive a traffic violation; Because they simply bring nothing but trouble! Specifically, every traffic violation in Saudi Arabia results in the payment of a huge fine or your vehicle being impounded; Not to mention also scoring a number of traffic points on your driver’s license. Violations can also turn into accidents that result in material and human losses, but if you need another incentive to give up bad driving behavior, you should know that monitoring repeated violations on your traffic record may lead to a higher price for comprehensive car insurance and third-party car insurance in the long run.

Below, we will answer the most important questions related to traffic violations and their impact on car insurance.

Why do traffic violations affect the price of car insurance?

Just like employers do background checks before hiring anyone, insurance companies do the same; to learn about your driving habits and the risk you will pose. In particular, insurers will want to check your driving record and inquire about traffic violations.

When reviewing the traffic record, insurance companies look for any negative indications that may cause an accident or a filed claim in the future. So, if your traffic record shows a history of accidents and traffic violations, this means you are most likely to file a claim for compensation soon. As a result, you may receive higher rates for your car insurance.

In contrast, insurance companies with clean records are considered less risky due to their commitment to safe driving. As a result, having a history of traffic violations or accidents will help you save money by getting a cheaper insurance rate and a no-claims discount. You can check your traffic fines history on Absher – all you need is your personal ID and driver’s license number.

Nonetheless, there are still many other factors that affect the price of your car insurance too! For example, the driver’s age, car model, national address, and many others.

Do all violations affect car insurance?

Insurance companies decide to increase the price based on violations and the consequent material and human losses; The more serious the violation you committed, the higher the possibility of an increase in the insurance price.

In order to be able to explain things better, insurance companies may not consider window tinting or wrong parking as a serious violation which can raise the price of your insurance; Because these traffic violations do not necessarily mean the driver is being reckless. However, insurance companies will not tolerate grave violations that could risk anyone’s safety.

Learn about violations that raise the price of insurance below.

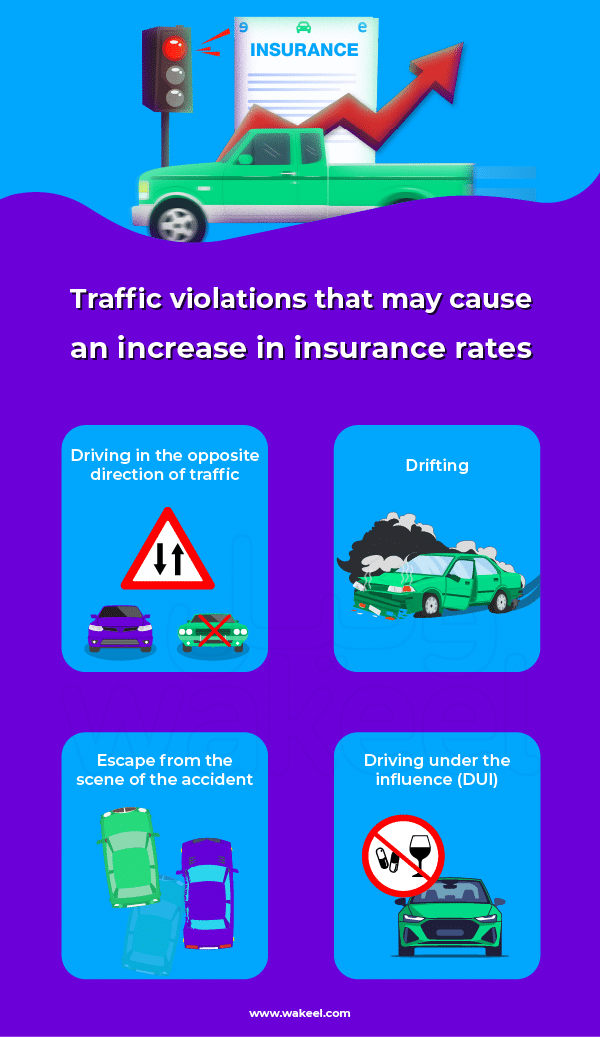

Traffic violations that may cause an increase in insurance rates

- Drifting

- Driving the vehicle in the opposite direction of the traffic

- Driving under the influence of an intoxicant or narcotic

- Fleeing from the scene of the accident

Overall, these violations cause accidents that result in various losses and damages. because this is a serious matter, the traffic system set a large number of traffic points for each violation. Once the offending driver’s license reaches 24 points, the driver’s license revocation penalty will apply.

Although the points recorded on the driver are canceled after one Hijri year has passed since the last violation committed. However, you will not be able to eliminate its effect on insurance as quickly; Most insurance companies require disclosure of violations recorded in the last 3-5 years.

On the other hand, if some of these violations did in fact cause an accident, then the insurance company has the right to reject the claims or apply the right of recourse to the policyholder. You are also more likely to lose a discount for not making a claim.

How do I reduce my insurance price after getting a violation?

- It is easy to avoid ALL traffic violations and the high insurance price just by adopting safe driving habits.

- Even Homer sometimes nods! The same goes for Saher cameras, which could make mistakes too. As a result, drivers may receive false or invalid traffic violations. So, if you believe there is an error, you can contest traffic violations electronically on Absher. This could get you out of paying the fine and raising your car insurance price!

- Make sure to authorize any additional drivers to avoid registering their own traffic violations against your traffic record.

- Increase your deductible. Insurance companies consider the deductible amount as evidence of liability, therefore, the higher the deductible, the lower the policy’s value, and vice versa.

- Compare insurance types and rates! Take some time to compare comprehensive and third-party insurance and understand the pros and cons of each so you can decide which type of insurance is right for your needs and budget. Then be sure to compare prices between insurance companies because prices vary greatly from one company to another.

Learning about the impact of traffic violations on insurance prices will help you to strengthen your adherence to traffic guidelines and break bad driving habits. Remember that traffic violations aim to spread and develop traffic awareness amongst all of society, and raise the level of compliance with traffic regulations and laws for road users. By avoiding fines, you can maintain the cheapest insurance rates, avoid fines and reduce the possibility of accidents, so stay safe on the road!