King Fahd Causeway insurance goes fully digital

From now on, car insurance is one less thing to worry about on King Fahd Causeway! Starting July 1, 2024, King Fahd Causeway announced that short-term policies (3, 5, or 10-day car insurance) will be available exclusively online.

🔎 Things you should know about

- Buying car insurance for King Fahd Causeway is required for all Saudi cars.

- United Insurance Company, UIC, is the provider responsible for mandatory insurance for vehicles crossing the King Fahd Causeway to Bahrain.

- You can now buy the car insurance required to enter Bahrain before reaching the King Fahd Causeway.

- You can still buy car insurance from the booths at King Fahd Causeway, but only if you’re staying a month or longer.

- Aside from car insurance, you’ll also need an authorization (permit) to drive the car outside of Saudi Arabia— if the car isn’t registered under your name.

Get your King Fahd Causeway insurance online

Here’s how you can buy car insurance before you’re out on your way to Bahrain.

1. Use UIC (United Insurance Company) website or app

To buy car insurance for King Fahd Causeway, use UIC’s website or mobile app. They have a straightforward process!

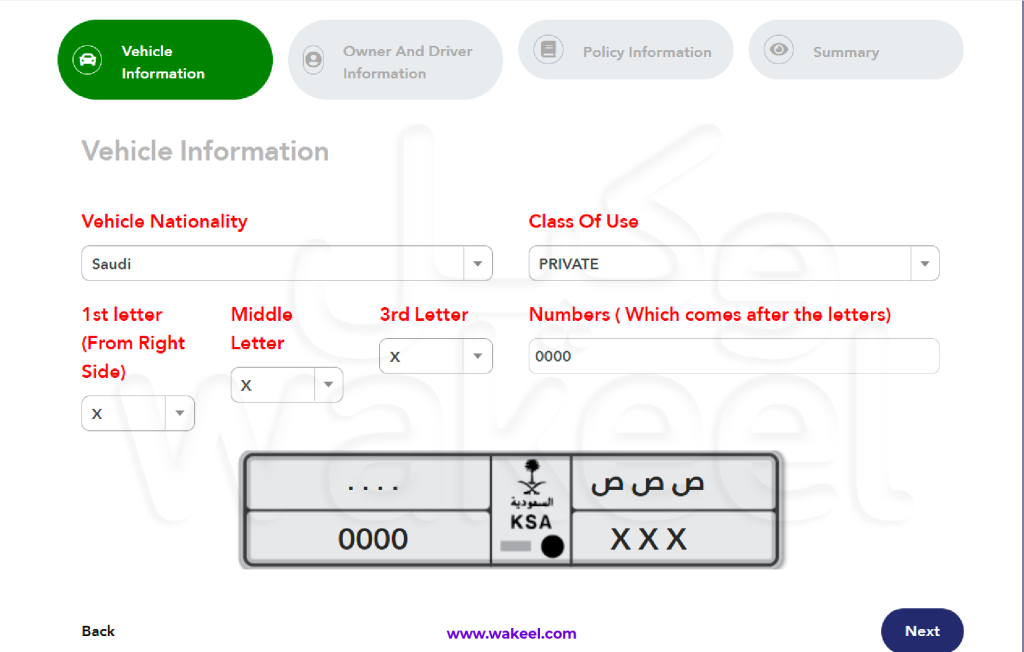

2. Enter car details

First, you’ll need to input your car number plate.

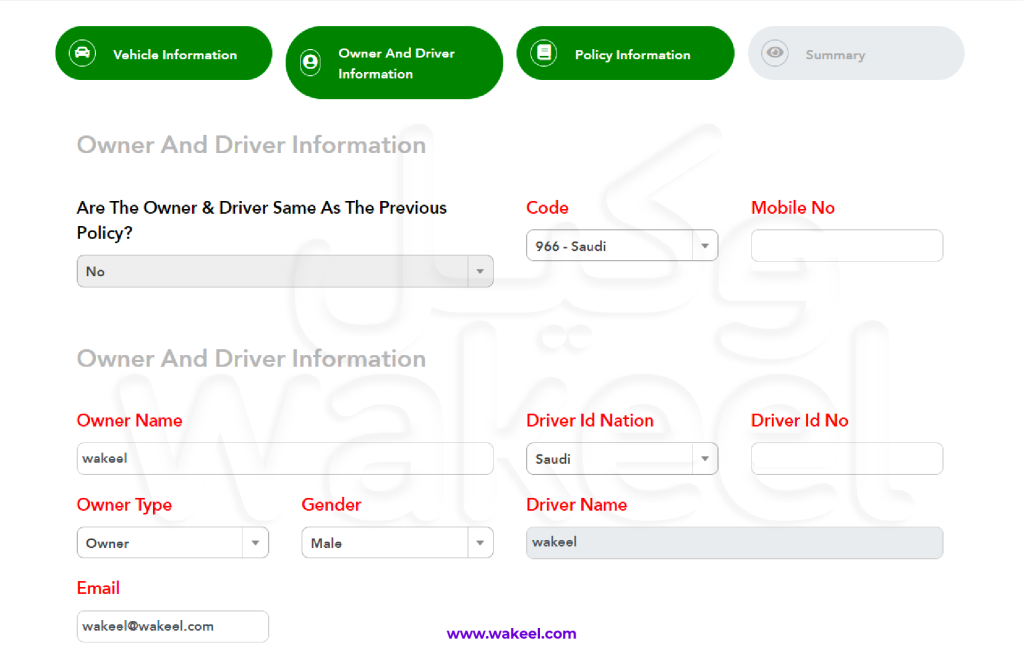

3. Enter driver & car owner details

Once you fill in your car details, you’ll need to provide the following information:

- Car owner/ driver name

- Gender

- Driver’s Nationality & ID

- Mobile number

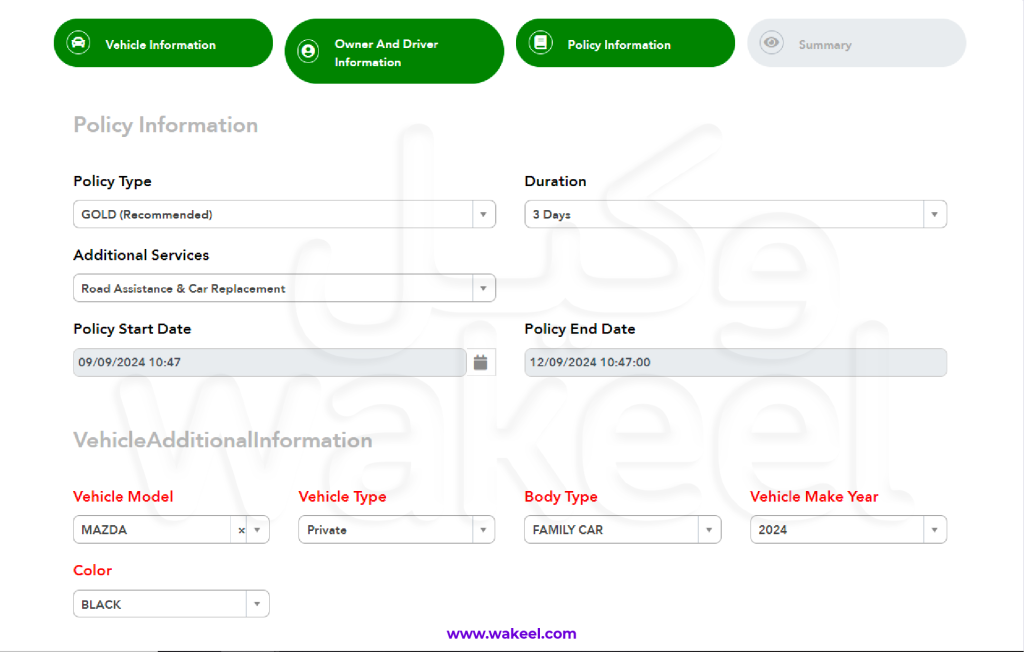

4. Select the insurance coverage you need

Next, you’ll need to select the insurance coverage you, along with any add-on options like roadside assistance or a replacement car.

You’ll also be asked to enter some details that can be found on your istimarah.

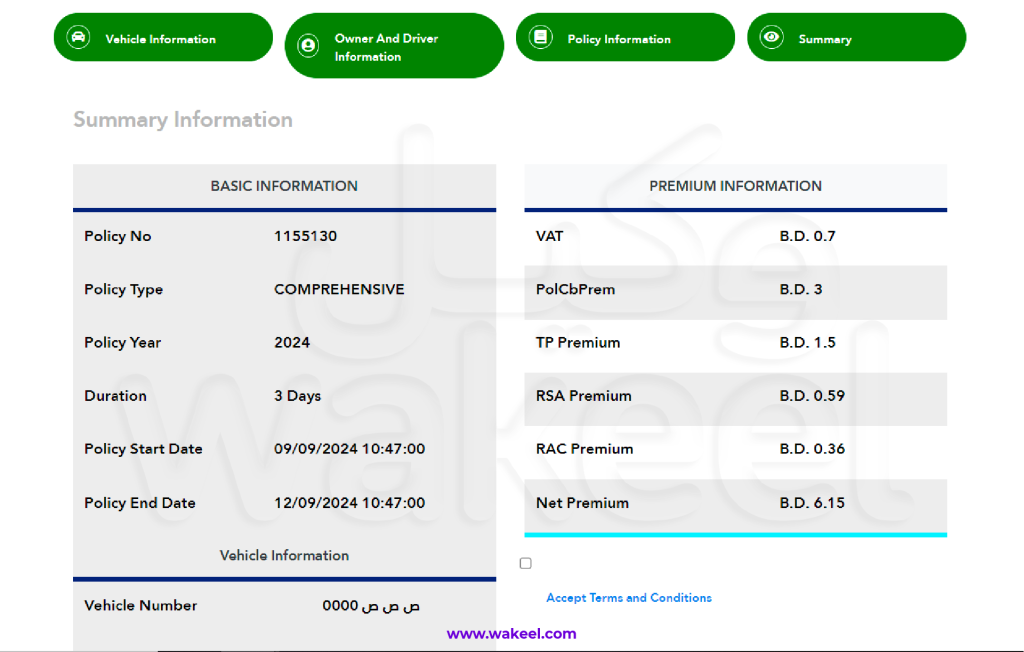

5. Review details & pay

Before proceeding to payment, you’ll be presented with a summary page that shows all the information you entered and outlines the selected coverage. Carefully review the details of your insurance policy to ensure everything is correct.

Once you’re done, choose your preferred payment method and complete the transaction. And that’s it!

You’ll receive a digital copy of your car insurance via SMS or email. Plus, you can view your car insurance and show proof of it on the UIC app.

What’s included in King Fahd Causeway insurance

King Fahd Causeway insurance offers the same cover as third-party insurance.

In simple words, it includes paying for the damage or injuries you cause to other people or their cars while driving in Bahrain. But it doesn’t include paying for your own injuries or any damage to your car if an accident is your fault – unless you add own damage cover.

What can you add to King Fahd Causeway insurance

For extra protection, you can add two optional add-ons to the standard King Fahd Causeway insurance: roadside assistance and own damage cover.

- With roadside assistance, you won’t have to stress if your car breaks down. You’ll be able to dial UIC’s roadside assistance on 80001023 to get repairs on-site, help you change a flat tire, tow you to the nearest repair shop, or even provide fuel delivery when you run out of gas unexpectedly.

- Without own-damage cover, you’ll have to pay the repair costs yourself. Own damage cover is the additional safety layer you need to be able to claim insurance for a car accident in Bahrain.

Tawuniya, in partnership with UIC, now offers cross-border insurance for Saudi cars in Bahrain. This insurance allows you to claim insurance for a car accident in Bahrain.

You can get it directly from UIC website when you buy car insurance for King Fahd Casueway. Just make sure to select “own-damage” when you select coverage.

Tawuniya cross-border insurance will cover

- Repairing your car after an accident – If you caused the accident, you’ll not have to pay for repairing or replacing your car.

- Injury to you – If you’re required to pay any medical expenses after an accident that was your fault, Tawuniya will cover the treatment costs.

- Fire, theft & malicious acts – Tawuniya cross-border insurance also provides cover for your car if it’s damaged by fire, or if someone attempts to steal the car or deliberately damage it.

What happens when a Saudi car gets into an accident in Bahrain

Here’s what to do, if you get into an accident in Bahrain:

- Report the accident. Use the eTraffic app to report minor car accidents in Bahrain. If anyone is injured, call Traffic Police on 199.

- Take photos of the damage and get a copy of the police report

- File a claim

- If you were at fault, the other driver can file a claim with UIC. They will guide them through the claim process, which should be straightforward.

- If you want to claim insurance for car accident in Bahrain, you can file a claim with Tawuniya (only if you bought their cross-border insurance)

Whether you’re making a quick one-day trip or staying longer, having own-damage cover with your King Fahd insurance means you can drive with peace of mind knowing that a car accident in Bahrain is going to be the last of your worries.

With that being said, you don’t necessarily need to buy “own-damage” cover every time you travel from Saudi to Bahrain by road! Many car insurance companies in Saudi Arabia, like Tawuniya and Al Rajhi Takaful, already include own-damage coverage for Bahrain or even the entire GCC in their comprehensive car insurance plans. So, if you have comprehensive coverage, you might already be covered for your trips without needing to buy anything extra!

The next time you renew your car insurance, use comparison websites to compare car insurance prices and features. Many car insurance companies in Saudi offer cheap car insurance online. So, don’t miss out on comparison websites!

Use wakeel to compare and buy car insurance, the entire process just takes a couple of minutes!