Manafith: insurance for cars entering Saudi Arabia

As a GCC local, you’re probably no stranger to the idea of driving your car to Saudi Arabia. For many of us, Saudi Arabia may already be our go-to for long weekends — either to see family, check out events, do Umrah, or even just cafe hopping in Al Khobar! But, since driving your car to Saudi requires crossing the border and entering a different country, there are some special preparations you need to make, and things you need to know before you go, to avoid any trouble.

If this is your first time travelling to Saudi by car (or if it’s been some time since you last did,) we’ll help you learn all about the requirements and Manafith, the car insurance required to enter Saudi.

What you will need to drive to Saudi

Before you set off, you’ll want to make sure that you have got everything covered.

1. Know which border is best to enter Saudi Arabia

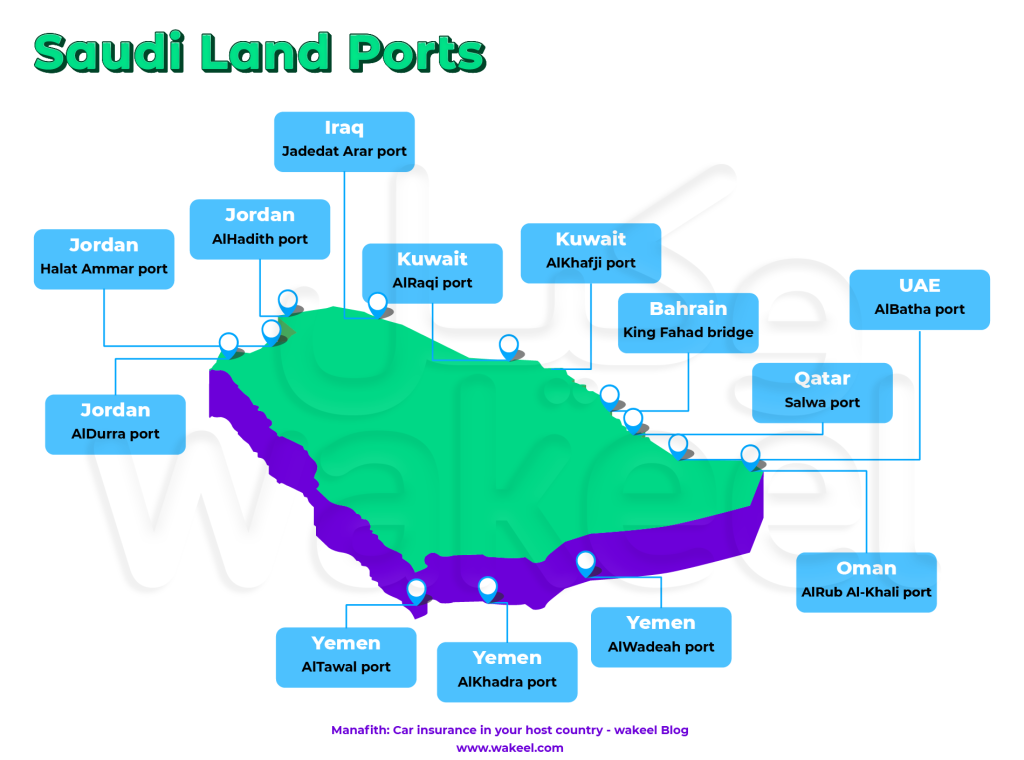

Saudi Arabia shares borders with Bahrain, Jordan, Kuwait, Oman, Qatar, UAE, and Yemen. Each country has a specific border crossing for cars entering or leaving Saudi Arabia.

Here’s a list of the borders:

- UAE to Saudi: Al Batha border

- Kuwait to Saudi: Al Khafji or Raq’i border

- Qatar to Saudi: Salwa border

- Bahrain to Saudi: King Fahad Causeway border

- Oman to Saudi: Rub Al Khali border

- Jordan to Saudi: Al Haditha border

- Yemen to Saudi: Al Wadiah border

Tip: You can check Saudi ports’ peak times for any of the locations online.

2. Get your documents ready

When entering Saudi Arabia by car, you’ll need:

- Your passport or ID card

- A GCC driving license or International Driving Permit (IDP)

- Your car’s registration papers (make sure the car is registered under your name or you have a permit from the owner)

- Manafith’s car insurance, a short-term TPL car insurance required to enter Saudi.

Where can you buy the car insurance required to enter Saudi?

You can buy the car insurance required to enter Saudi on Manafith. It’s an online service that lets you buy insurance before you even get to the border, so you can skip the lines. Here’s how it works:

- Download Manafith app from the Apple Appstore or Google Playstore.

- From the homepage, choose your car type and how long you’ll be in Saudi.

- Next, pick your car insurance start date and which border you’ll use.

- Enter your car details.

- Use your credit card, debit card, or Apple Pay to pay.

- The app will then generate your insurance policy and it should be ready within 3 hours.

What does Manafith insurance cover?

Manafith car insurance will protect you from paying bills if you cause an accident and hurt someone or damage their car while driving in Saudi. Much like a TPL insurance policy, there are a few things it doesn’t cover. For example, Manafith car insurance doesn’t cover the following:

- Repairing your own car after getting into an accident.

- Injuries to you or your passengers

- Roadside assistance.

What happens if I get into a car accident in Saudi?

- Inform Najm about the accident, and wait where you are until they arrive.

- You can call Najm at 199033 or 920000560, or message them on WhatsApp at 920000560. If someone gets hurt, call the Saudi Red Crescent at 997 or the traffic department at 993.

- Najm will investigate the accident, decide who’s to blame, and issue an official accident report.

- Once the accident report is ready, the other driver can go ahead and file a third-party claim with the company that issued your car insurance.

- As mentioned, Manafith will not cover your own car damage. However, if you have comprehensive car insurance that offers GCC coverage or KSA coverage, you can file a claim when you get back home and get your car fixed.

Planning a move to Saudi?

Like many countries around the world, Saudi requires you to have a minimum level of car insurance to drive. If you’re planning to relocate to Saudi — or happen to be a cross-border worker, it’s important to know your options!

Anytime you are shopping for car insurance, it’s important to know your options. Online insurance comparison website make it easy to check car insurance prices in Saudi from home without having to wait in line or call a bunch of different companies to get a quote.

We recommend getting comprehensive car insurance in Saudi to make sure you’re covered for all scenarios, including accidents, car theft, or striking a stray camel. With comprehensive insurance, you can also add extra coverage for driving outside of Saudi Arabia. This way, you wouldn’t have to worry about any accident that happens even when you’re visiting Bahrain, UAE, or Kuwait.

Get ready, get packing, get insured!