Saudi drivers, get some of your insurance money back!

Before the year ended, most of us got text messages from our insurance companies saying something like, ‘The company has decided to distribute a part of the net surplus to eligible policyholders..’ Surplus is a motor insurance benefit that refunds the policyholder a small percentage of the amount spent on their third-party or comprehensive car insurance.

So, you might wonder, ‘How much money am I going to get?’ and ‘How can I actually get it?’ Well, that’s exactly what we’re breaking down in this blog!

Key takeaways

- Surplus is the ‘leftover’ money from the premiums people paid for their car insurance.

- By law, insurance companies in Saudi must share 10% of the ‘leftover’ money with their customers.

- You can check if you’re entitled to receive any money (surplus) from your car insurance on Najm website or app.

- How much you get depends on the type of insurance you have. If you have comprehensive insurance, you’ll usually get more than if you only have third-party insurance.

- You can either get the cash directly deposited into your account, or use it as a discount to get cheaper car insurance next time.

So, what is surplus?

Surplus is an amount of something left over above what is used or needed. That, in effect, is what remains from premiums after an insurance company has paid out claims and covered its operating expenses.

Now, here’s the thing: not everyone with car insurance gets some cash back!

First, the insurance company has to actually have some ‘leftover’ money. If they paid out more in claims than they collected in premiums, there won’t be surplus to share!

Second, the Saudi Insurance Authority has rules about surplus distribution. These rules set limits on how much surplus can be shared or who is even eligible to get it.

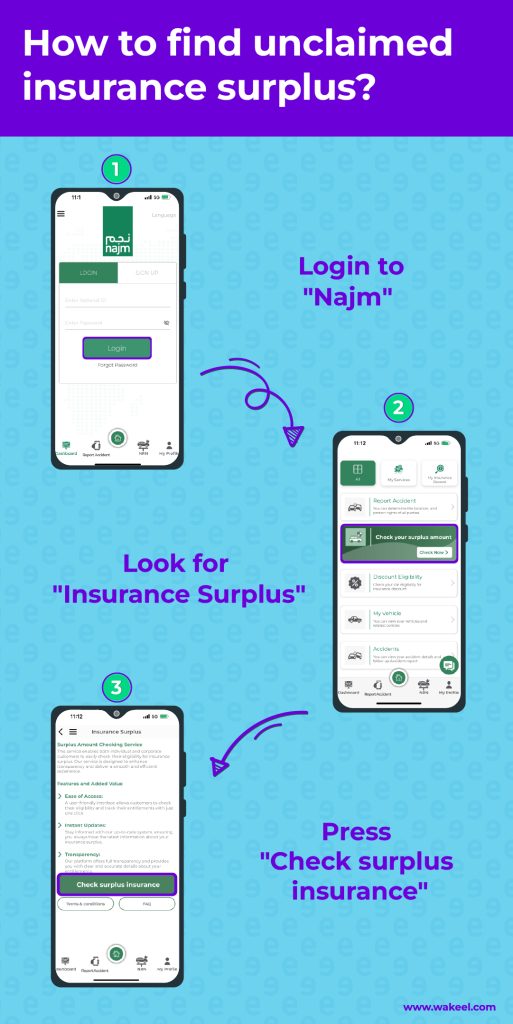

Check surplus balance on Najm

🚨 If you have a car on lease

If you’re leasing your car, you’ll need to check with your leasing bank/ company about any insurance surplus.

How much surplus can you expect from car insurance companies in Saudi?

Don’t expect to get rich from it, though. The surplus amount car insurance companies in Saudi give is usually pretty small. Often less than 4 Saudi Riyals!

Nonetheless, it’s your money and you choose what to do with it.

- You can ask your car insurance company to send the money directly to your bank account.

- You can also save it to get cheaper car insurance prices when it’s time for renewal.

- Some car insurance companies, like Al Rajhi Takaful and Tawuniya, give you the option to donate your surplus to charity. It’s a great option if you’re feeling generous!

Spot any mistake?

If you think the Surplus amount Najm shown on Najm is wrong, contact your insurance company directly.

Want cheaper car insurance this year?

While the surplus ‘cash back’ may not be BIG, getting any money from your car insurance is a huge plus!

To get more car insurance discounts, try your best to be a safer driver this year 😉 Being a safe driver means more no-claims discounts and more chances to get some money back when car insurance companies in Saudi announce surplus distribution. But overall, the best way to find cheaper car insurance is to shop around & compare.