Tips for getting cheaper car insurance in Saudi Arabia

If you’re looking for cheaper car insurance in Saudi Arabia, you need to know that prices aren’t the same for everyone. Your age, car, driving history, and even your location all play a role! There’s also a big difference between comprehensive insurance and third-party car insurance prices in Saudi Arabia.

But don’t worry — there are ways to get low price car insurance without having to think about using Tabby or Tamara. Here’s how 👇

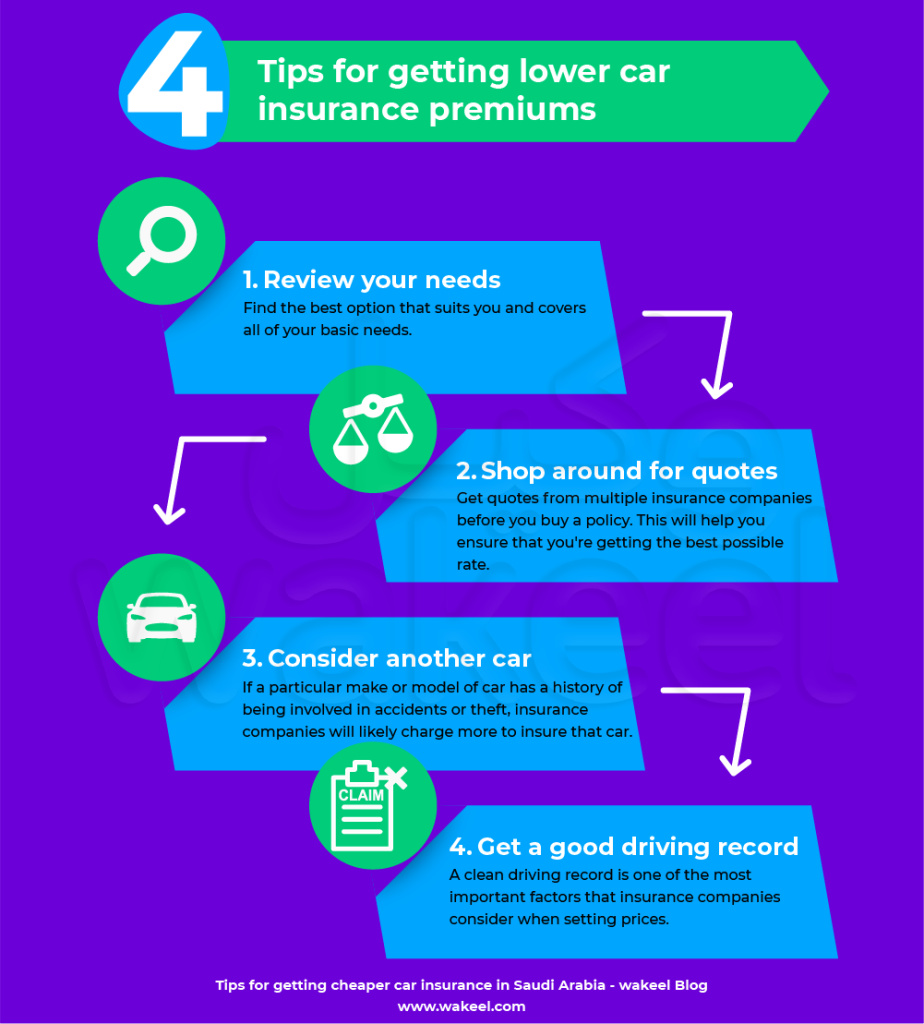

How to get cheaper car insurance in Saudi 🤔

1️⃣ Only pay for what you need 📝

Don’t choose a more expensive car insurance policy with unnecessary optional add-ons. Go for one that has everything you need for a great price. The cheapest car insurance in Saudi Arabia is third-party car insurance, which only covers damages to the other driver in an accident and not fixing your car.

To save money, you could switch from comprehensive to third-liability. But if your car is important to you, look for a “lite” version of comprehensive, like:

- Tawuniya’s Sanad Plus

- Takaful Al Rajhi’s Wafi Smart

- Or any other car insurance policy that’s a mix of both.

2️⃣ Increase your deductible 💳💰

A car insurance deductible is the amount you pay out-of-pocket when filing a claim. If you increase your deductible, your comprehensive insurance price will go down. The higher the deductible, the lower you’ll pay for your vehicle insurance — and vice versa.

3️⃣ Check what your credit card has to offer 💳

Many credit cards in Saudi will get you a discount on your car insurance with some providers. Before renewing your insurance, check your bank’s website or social media pages to see if there’s a discount offer you can use.

4️⃣ Renew during promotion times 🎉

Almost all car insurance companies in KSA offer special deals and discount codes around:

- ✔ Foundation Day

- ✔ National Day

- ✔ Black Friday

- ✔ End of the Year

If your car insurance is close to expiring during one of those sales, renew early and set the start date after your current policy ends. That way, you’ll get cheaper car insurance by getting both discounts: sale discount and your Najm discount.

5️⃣ Compare quotes and shop around 🧐

You won’t be surprised to hear that our top tip for getting cheaper car insurance in Saudi is to shop around and compare!

That’s because car insurance prices in Saudi, especially for comprehensive car insurance, differ a LOT! We’re talking 20% or more! So, using comparison sites like Tameeni or wakeel is a smart move. They show you a few quotes, let you sort by price, and allow you to buy car insurance online.

Just a heads up

Don’t settle for the first comparison website offer you find. Check a few to make sure you’re getting the absolute best deal!

6️⃣ Drive with care to keep your Najm discount📜

Building up your Najm No-Claims Discount will help you to get cheaper car insurance in Saudi Arabia because insurers reward drivers who are claim-free with discounts at the time of renewal.

With a clean driving record, you can get a discount of up to 60%! So, try your best to follow the rules and drive defensively —i t pays off!

⚠️ What to avoid when looking for cheap insurance?

- ❌ Don’t change your city or National Address.

Car insurance companies in Saudi bases prices on the liklihood of accidents happening in you location. If you change your city or address just to lower the price, it could be considered false information, leading to tourble!- ❌ Don’t buy a car that’s expensive to insure.

Some cars have more expensive insurance —especially those popular among young drivers or used by delivery drivers in Saudi. That’s because they tend to be invovled in more accidents, making their insurance more expensive.

💡 Last but not least, don’t just focus on price!

Saving money is always great, but don’t just focus on buying the cheapest car insurance. Shop around for the right quote, from the right car insurance company. For that, you’ll need to check customer reviews and what people have to say about the company’s service first. Because buying car insurance from a good company means smooth claims and reliable support when you need it most.