Which Accidents Affect Car Insurance

Car accidents are a fact of life. And, with more people driving today than ever before, our roads are becoming increasingly congested; accidents are by default becoming more frequent. In 2021, a total of 1.8 million traffic accidents resulted in property damages only. That’s up about 28% over 2020. These figures affect how much insurers have to pay for claims, and thus how much they charge for TPL or Comprehensive insurance premiums.

Additioanlly, car insurance takes into account individual risks ie. your personal driving record. Generally, having accidents and claims on your driving record increase risk — and therefore rates. So, keeping the count down is in your best interest! Here’s what you should know about accidents’ impact on car insurance costs, and what you can do to lower your costs.

How do car accidents affect my insurance?

The first thing to know is that your driving record significantly impacts what you pay for car insurance. Car insurance is all about risk. Basically, risk is the chance of occurrence of something unexpected that might cause economic losses — whenever risks increase, your costs will increase too.

To measure your risk, insurers use different information about who you are, what car you drive, and how you drive. According to insurance industry data, if you had accidents or serious traffic violations on your driving record, it’s likely you’ll file more claims than those who don’t. Accordingly, insurers will charge more to account for possible future losses.

How much does your insurance raise after an accident?

It’s hard to predict exactly how much your rates will rise after an accident; because it depends on several factors eg. the cost of the claim as well as your previous driving record and your claims history.

In addition, each company weighs these factors differently. As a result, the hike can vary widely between insurers; which explains why many start price comparisons before switching insurance providers.

Types of car accident claims

Typically, your car insurance rate increases after an at-fault accident —when you’re 25%-100% responsible for an accident. Here are several common causes for at-fault accidents claims:

Rear-end accidents

The most common reason for car insurance claims is definitely rear-end accidents! This accident involves the front bumper of one car crashing into the one in front of it. It’s generally believed that the rear car driver is automatically at fault. However, there are times when the front car driver may be to blame. Namely, if they stop suddenly for no reason.

Prevention tips:

- Minimize distractions

- Don’t tailgate

- Learn defensive driving techniques

Side-impact accidents

Typically, these accidents happen most frequently at intersections due to drivers failing to adhere to traffic signals or yield the right-of-way. At intersections, drivers often come into conflict with other drivers; because their intended courses of travel intersect, and thus interfere with each other’s routes.

To prevent these accidents from happening, every driver should know the correct right-of-way rules. The right of way must be yielded to others in the following instances:

- At a yield sign;

- Oncoming traffic, when you enter a main road;

- Drivers inside the roundabout, before entering;

- Pedestrians in a crosswalk;

- At uncontrolled intersections where cars are already in the intersection;

- Emergency vehicles, or presidential and other VIP motorcades;

- Right turns to take the right of way over left turns.

Parking lot accidents

Just like intersections, many accidents happen in parking lots too. In fact, they are more common than you might expect; because tight spaces and poor sight lines in a parking lot increase the possibility of scraping or otherwise damaging a parked car.

To help avoid parked car accidents and claims, here are some suggestions:

- Avoid parking your car in the busiest part of a parking lot, or near poorly parked cars. Instead, pick the outskirts to lessen the chances of hitting other cars while pulling into or out of adjacent spots. Moreover, this can also prevent aggressively swinging doors from causing expensive and unsightly damage.

- At the same time, be street-smart and steer away from busy streets and driveways; to minimize the chance of someone hitting your parked car and leaving.

A comprehensive claim can also affect your insurance,

As unfair as it may sound, some not-at-fault accidents can also affect what you pay for car insurance, but probably not by as much as an at-fault accident — that’s the silver lining!

It all goes back to the way car insurance companies calculate risk. Statistically, drivers who file comprehensive claims, which often cover non-collision damage that happens outside of their control, are more likely to file another later on. Thus, these claims can trigger a price increase.

Below are some examples of comprehensive claims:

Single-vehicle accidents

Many comprehensive claims result from single-vehicle accidents. A single accident is any accident that causes damage to only one vehicle. This includes hitting a fixed object such as road barriers, street signs, pavements, or trees.

In most cases, single-vehicle accidents are a result of distracted driving, speeding, or other unsafe behavior; so it’s not really hard to prevent them.

Car theft claims

Not only does comprehensive insurance cover non-collision damage, but it also covers car theft and break-ins. Oftentimes, thieves target cars’ parts and contents instead of stealing an entire car. Actually, stealing parts is easier to accomplish, and more profitable.

To deter thieves and prevent any potential unnecessary damage to your car, look into installing anti-theft devices, alarms, or even dash cams.

Windshield damage

A lesser-known benefit of car insurance is that it covers windshield damage. Your windshield can be chipped or cracked, but most windshield damage happens because of flying debris accidents. Your comprehensive insurance will cover a replacement, but it could affect your future insurance rates.

Help prevent this damage by painting a safe distance between you and other cars or trucks. Also, don’t drive behind loaded trucks. Some pieces may be thrown up at your windshield cracking it.

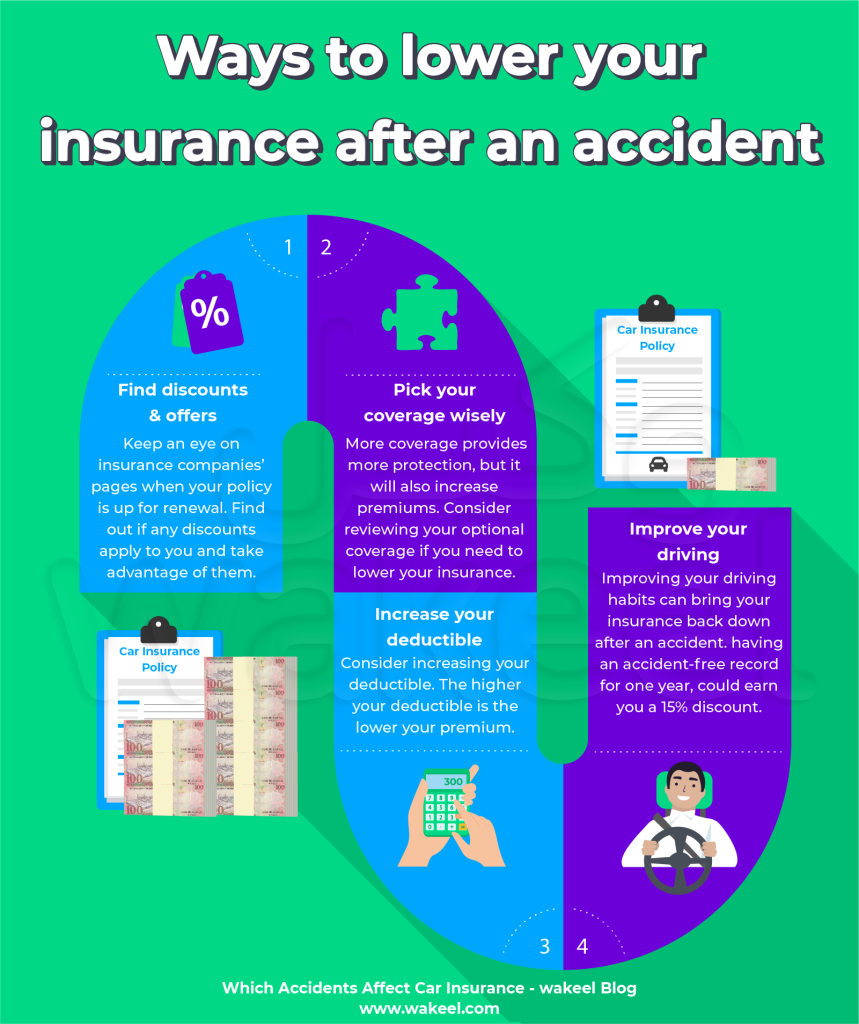

Ways to lower your insurance after an accident

It’s true that accidents and claims on your record can significantly affect your insurance. Nevertheless, there are still ways to hedge the increase.

- Find discounts & offers. Many insurers roll out special discounts and deals throughout the year; so keep an eye on insurance companies’ pages when your policy is up for renewal. Plus, many employers offer a variety of employee discounts. Find out if any discounts apply to you and take advantage of them.

- Pick your insurance coverage wisely. Although adding more coverage provides more protection, it will also increase premiums. Consider reviewing your optional coverage if you need to lower your insurance costs.

- Increase your deductible. If you can’t give up your comprehensive coverage, increase your deductible. A deductible is the amount of money you pay out-of-pocket before your insurance company will cover any comprehensive damages. The higher your deductible is the lower your premium.

- Improve your driving. Improving your driving habits can bring your insurance back down after an accident. While improving driving is a long-term strategy, having an accident-free record for one year, could earn you a 15% discount.

All in all, driving safely helps minimize the risk that you’ll be involved in an accident. Multiple claims, accidents, and violations affect your insurance profile, and in turn, will result in higher rates.

Although it may be difficult to find a car insurance policy at the same price you were paying prior to an at-fault accident, it’s not impossible! To find the best prices, make a habit of price comparison. Insurance premiums vary substantially from company to company, so it pays to do a little research. If keeping up with money-saving strategies makes buying your insurance feel like a homework assignment, try automating the work! There are many price comparison websites in Saudi that help you compare personalized quotes from multiple insurance companies in Saudi.