Will My Car Insurance Cover a Hit & Run in Saudi?

Until it happens to you, you will never think someone could hit your car and continue driving as if nothing happened! This is what we call a “hit-and-run” accident. In Saudi, a hit-and-run accident happens when a driver leaves the scene instead of stopping to report the accident to Najm or Moroor.

It’s bad enough when it happens to you while you’re driving, but it’s even worse when your parked car gets hit and the driver doesn’t leave a contact number!

👇 Here’s what to do if a driver runs away after the accident & how your car insurance can help with repairs.

🔍 Hit and Run: What You Need to Know

- Remaining at the scene of an accident isn’t just the right thing to do — it’s the law in Saudi Arabia.

- After a hit-and-run, forget Najm. Call Moroor. They will help you file an accident report and attempt to find the other driver.

- Hit-and-run drivers in Saudi get hit with a fine of 10,000 Saudi Riyals.

- When Moroor charges a driver for leaving the scene of an accident, they’re automatically held 100% responsible for the. Plus, their car insurance won’t cover any of the costs.

- Excuses like being in a rush, scared, or having expired license or expired car insurance — won’t cut it!

- Even if there’s no sign of the driver who hit you, you’d still be able to repair your car if you have comprehensive insurance.

What to do in a hit-and-run in Saudi

Being in a car accident will always leave people feeling shaken up — but getting hit by a driver who runs away is even worse! If you ever find yourself in a hit-and-run situation, follow these steps:

Step 1: Compile any information

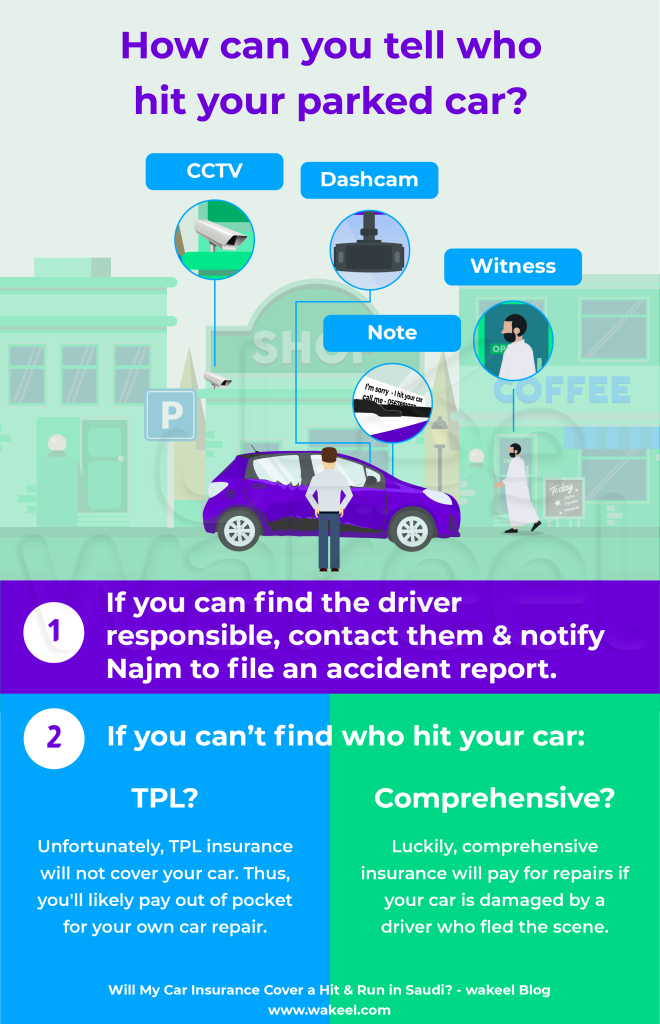

Whether you were there or not when the accident happened, the first thing you need to do is get as much info as possible about the other driver.

- A license plate is a car’s ID. So, try your best to get a picture or memorize it! A license plate will help Moroor find the driver fast and make them pay for the damage.

- If you weren’t present at the time of the accident, check for:

- a note

- CCTV cameras

- eyewitness

💡 Buy a dashcam. It will be worth it in these situations!

Step 2: Report the accident

Most drivers in Saudi know that if they’re involved in an accident on the road, they should report the accident to Najm. But for a hit-and-run accident, you’ll need to contact Muroor. Provide them with as much information as you can about the other driver and the accident.

Step 3: Check if your insurance covers repair

If you have comprehensive car insurance,

Contact your car insurance company. They’ll require an accident report (from Muroor) before processing your claim for car repairs.

- Keep in mind that you’ll likely have to pay a small deductible, while your insurance company covers the rest of the repair costs.

- The deductible is the amount you agree to pay when you buy your insurance policy.

- For example, if your car repairs cost 8k riyals and your deductible is 1k riyals, you’ll pay 1k, and the insurance company will pay the remaining 7k.

If you have Third Party car insurance, it won’t help!

That’s a bummer, we know. Third-party car insurance is cheaper because its limited. It primarily covers damages you cause to other cars — but not your car.

So to get your car repaired, you’ll need to:

- pay out of pocket

- wait to hear back from Moroor

If Moroor was able to find the other driver

The other driver will be 100% at fault.

- If the other driver has insurance: Their insurance company will pay the cost of repairing your car after you submit a claim.

- If the other driver doesn’t have insurance: They will be personally responsible for paying for the repairs to your car.

Will my car insurance price increase after a “hit and run”?

Regardless of whose fault it is, some insurance companies may raise their rates even if you’re not at fault. Typically, when you file any claims, you’ll notice an increase in the price of the car insurance policy in the next year.

How can I avoid further losses?

Make sure to park your car appropriately in a safe place.

Particularly, in busy neighborhoods where it’s impossible to find an empty spot. In general, you should avoid parking your car outdoors, instead, keep it in a garage if possible. It can significantly reduce risks and expenses; also, some companies consider it a factor that determines your insurance rates.

I hit a parked car, what to do now?

Accidents happen all the time. Still, you have to do the right thing always. No matter how minor the accident appears to be, take accountability. Otherwise, face the consequences of paying 10,000 riyals.

Don’t drive away from the scene.

- Wait around for a while, the owner might return to his car soon. Also, you could ask around.

- Document the accident and report it to the authorities to avoid liability.

- Leave a note with your name, contact information, and your car insurance company.

Third-party insurance means that you get the minimum legal coverage for repairing someone else’s car and you undertake to get your car repaired using your own money.

If you don’t have comprehensive, then think about upgrading!

In the end, dealing with a hit-and-run in Saudi can be a real headache, but having comprehensive car insurance can totally save the day! While TPL insurance might leave you hanging in these situations, going comprehensive gives you that financial safety net. It’s super important to know your policy inside out and make sure it’s got your back. Don’t wait until it’s too late. Compare comprehensive car insurance quotes now. A price comparison website will give you access to exclusive deals, discounts, or special offers from insurers that might not be available elsewhere.