Your Extra-Safe Car May Cost More to Insure

You know there are a few choices you’ll need to make when shopping for your next car. But one thing’s for sure – you won’t give in on car safety! Over the past ten years, cars have evolved significantly to become safer than ever before, thanks to Advanced Driver Assistance Systems (ADAS). These systems have proven their ability to reduce accident damage and maintain the safety of drivers and passengers. However, the convenience of ADAS comes at a cost, and it can end up adding to the overall expenses, including your car insurance cost!

So, let’s dig into the details of these systems and find out how they can affect your comprehensive car insurance cost.

What makes a car safe?

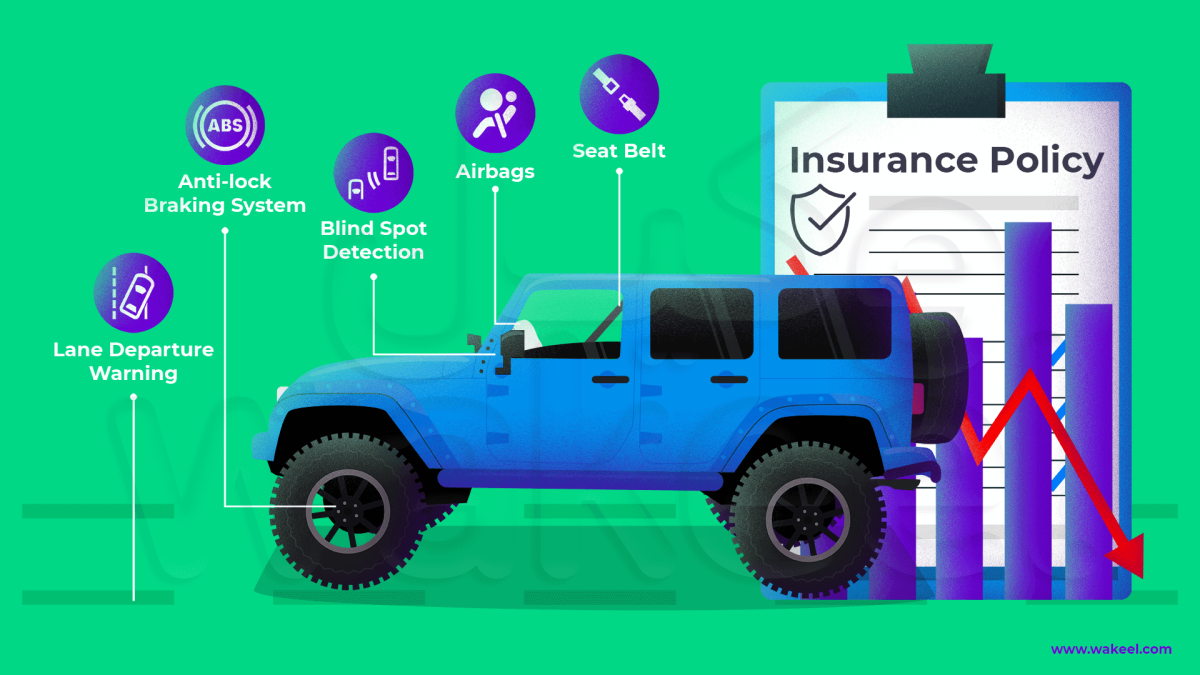

Once upon a time, car safety systems were all about seatbelts and airbags. These features did their best to protect passengers during accidents, but advanced driver assistance systems, or ADAS, take it a step further. ADAS uses sensors and software to keep an eye on your car’s surroundings. It can warn you and even step in to help you avoid accidents or lessen their impact.

These safety systems are becoming more widely available. Here are 8 ADAS features to look for in your next ride

8 ADAS features for safer driving

- Lane departure warning. This technology uses a camera system to track the car’s position along with lane markings and warns the driver if they are unintentionally driving too close to the edge or outside of the lane.

- Lane keeping assist. This technology helps bring the car back to the middle of its lane when the driver doesn’t respond to a lane departure warning.

- Adaptive cruise control. This feature slows and speeds up your cart to keep pace with the car in front of you to help maintain a safe driving distance.

- Right-side rearview camera. Mounted on the right side-view mirror, this camera activates when the driver uses their right-side turn signal. The camera provides a rearview look of the right side of the car to help the driver change lanes safely.

- Self-park or park assist. This automated steering technology activates to help a driver park the car while the driver operates the gas and brake. Some self-parking systems also handle acceleration and braking.

- Forward collision car. This technology scans for cars or objects ahead of the car and warns the driver of an impending collision using a visual or audible signal.

- Automatic emergency braking. This safety feature works with forward collision warning to help the driver avoid a collision by automatically applying the brakes.

- Rear cross-traffic alert. This technology alerts the driver if something crosses the car’s path as it moves in reverse. Some systems will also deploy automatic braking if an object is detected.

While these systems contribute to driver and passenger safety, they cannot fully replace human responsibility. Ultimately, the driver remains primarily accountable for safe driving.

Can safety features cut car insurance cost?

The relationship between a car’s safety features and car insurance cost can be a bit tricky! While a safer car can help you save money by reducing the likelihood of an accident, a high-tech car may cost more to insure.

The main reason is that repairing sensor-packed cars can be more expensive, outweighing any savings from fewer accidents. The sensors that power those systems make cars much more expensive to fix when they crash. Generally, many of a modern car’s ADAS sensors are located in easily damaged places like bumpers, wing mirrors, and windshields, repairing even a mere fender-bender or a chipped windshield might not necessarily as simple or cheap fixes as it once was.

Besides, ADAS is still so new, and insurance providers haven’t fully determined how effective these systems are across different cars, drivers, and real-world driving situations. As more research backs up these findings and the technology used for advanced driver assistance systems becomes more affordable to install and repair, insurance companies may begin to offer lower car insurance prices for ADAS-equipped cars. So, until then, your best bet is to shop around for car insurance! Use an insurance price comparison website to find the best rate that suits your needs. Insurance comparison websites in Saudi can help you find the cheapest insurance with the best coverage.

Here’s what to do to save on your insurance costs

All in all, driver assistance systems can offer significant benefits in terms of safety, comfort, and well-being. However, buyers should be aware of all potential costs and compare them with the expected benefits before buying a car equipped with these systems.

Still, those safety features can make your insurance cheaper over time by helping you avoid accidents that would otherwise hike up your rates. Plus, it’s always wise to compare quotes from multiple insurers to get the best price for the coverage you need.